In this article, we explore how much it takes to buy a HDB flat or a condominium.

What you can afford depends on your current income, debt obligations, expenses, savings and your loan eligibility amount.

Here are several factors that you need to consider before taking on the purchase:

- Total Debt Servicing Ratio (TDSR) / Mortgage Servicing Ratio (MSR)

- Buyer’s Stamp Duty and Additional Buyer’s Stamp Duty (ABSD)

- CPF funds allowable for down payment, stamp duties and legal fees and cash reserves

- Loan-To-Value (LTV) and Cash-Over-Valuation (COV)

- Monthly mortgage repayment and loan tenure

- Reserve fund for fluctuations in interest rates, loss of income, emergencies etc

- Other miscellaneous expenses like property tax, maintenance/conservancy charges, fire and mortgage insurance, and renovation and repairs

(Click on the topics above for more information.)

Below is a list of the payments you need to get ready:

- Option fee: paid in cash when you make an offer to purchase, in return for an Option to Purchase (OTP)

- Initial down-payment: how much you pay and the amounts payable in cash and from CPF savings depend on the value and type of property you buy, whether you have an existing housing loan, as well as the tenure of the loan you intend to take

- LTV/COV: If the purchase price is higher than the bank valuation of the property, you would need to come up with the difference in cash.

- Stamp duty on purchase and Additional Buyer’s Stamp Duty (ABSD)

- Legal/conveyancing cost

- Agent’s commission (may or may not be applicable to purchase of private properties)

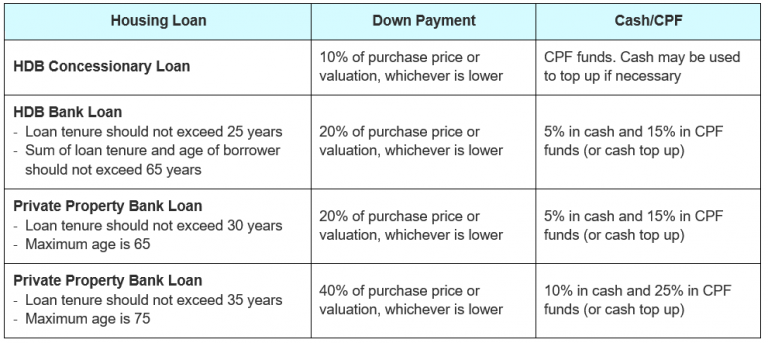

The chart below shows the amount you need to set aside on your down payment as a first property owner. As you can see, a longer tenure can be achieved if you put down a larger down payment.

Your loan tenure depends on your age.

For HDB you may loan up to a maximum of 25 years. For private properties, you may loan up to 30 years up to age 65. However, it is possible to extend your loan up to age 75 by putting down a higher down payment. Do talk to our Property Science consultants to find out more.

Illustrations

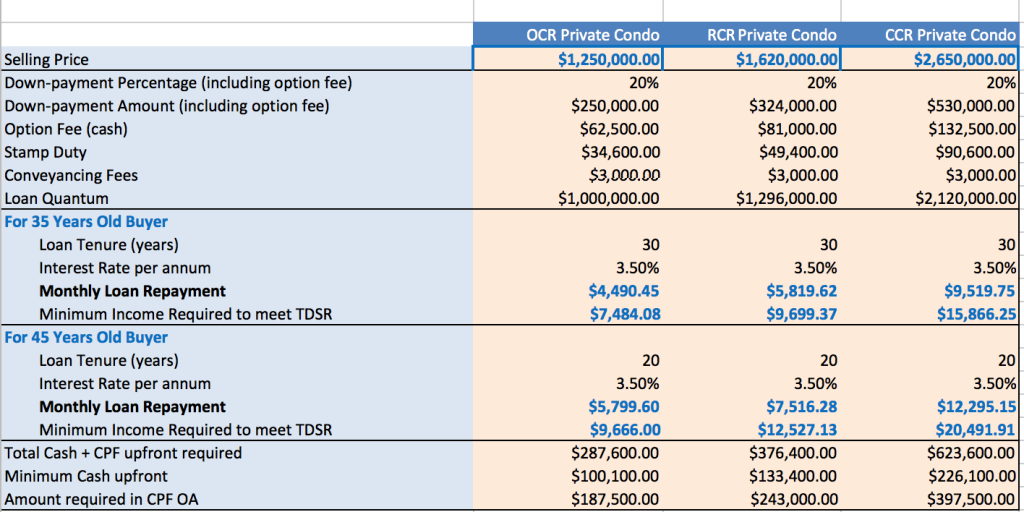

Property Science has done up some examples of buyers with different estimated incomes and loan tenures who are purchasing either HDB, EC or private properties. We have also estimated the income needed for a 2 bedder condominium in either the Core Central Region (CCR), Rest of Central Region (RCR) and Outside Central Region (OCR).

In this example, we assume the buyers are going for a bank loan instead of a HDB concessionary loan of 90%. The interest rate at 3.5% is a ‘stress test’ banks use to assess the loan quantum. Current rates hover at about 1.8% to 2% so your monthly repayment will be lower than those in the examples.

For HDB, the typical option fee is $1000 (although it can be less). In order to exercise the OTP, the buyer can pay up to a maximum of $5000, (inclusive of option fee), to the seller. We assume the figures are $1000 and $4000 respectively. Therefore, the initial Payment is the compulsory 5% cash component after payment of the Option Fee and Option Exercise Fee.

The Minimum Cash Upfront is assuming that you choose to pay your Conveyancing Fee and Stamp Duty on top of the 5% cash component by cash (although it can be paid with the CPF if sufficient). The Amount Required in CPF OA therefore is the remaining down payment of 15%. The Number of Years required portion gives one an estimate as to how long one needs to accumulate that 15% in the CPF OA.

In this example, we have used a double income totaling to at least $8400. If there are two borrowers for the property loan, we will use an Income Weighted Average Age formula to derive the final monthly loan figure.

The option fee is 5% of the purchase price, paid in cash. For Executive Condo (EC), we have to use HDB’s Mortgage Servicing Ratio of 30% to calculate loan size. Private condos and landed properties will be subject to Total Debt Servicing Ratio of 60% instead.

The Minimum Cash Upfront is assuming that you choose to pay your Conveyancing Fee and Stamp Duty on top of the 5% cash component by cash (although it can be paid with the CPF if sufficient). The Amount Required in CPF OA therefore is the remaining down payment of 15%. The Number of Years required portion gives one an estimate as to how long one needs to accumulate that 15% in the CPF OA.

In this example, we illustrate the costs and income needed for a 2 bedder 900sf condominium in either the Core Central Region (CCR), Rest of Central Region (RCR) and Outside Central Region (OCR). Prices are based on the time of this article, for a newly-TOP unit.

The interest rate is kept at 3.5% although current rates hover at about 1.8% to 2% so your monthly repayment will be lower than those in the examples.

We’re here to help you on your real estate journey.

Contact us using the form on this page and our Consultant will be in touch with you very soon.

Or contact us by phone/email.

Call: (+65) 8363 2331 / 8778 8778

WhatsApp: Glynis Tan / Benjamin Yeo

Email: findout@property-science.com