Buyer's Stamp Duty (BSD)

The Buyer Stamp Duty (BSD) is computed based on the purchase price or market value of the property, whichever is higher.

All residential and non-residential properties will be subject to BSD in transfer or sale and purchase transactions.

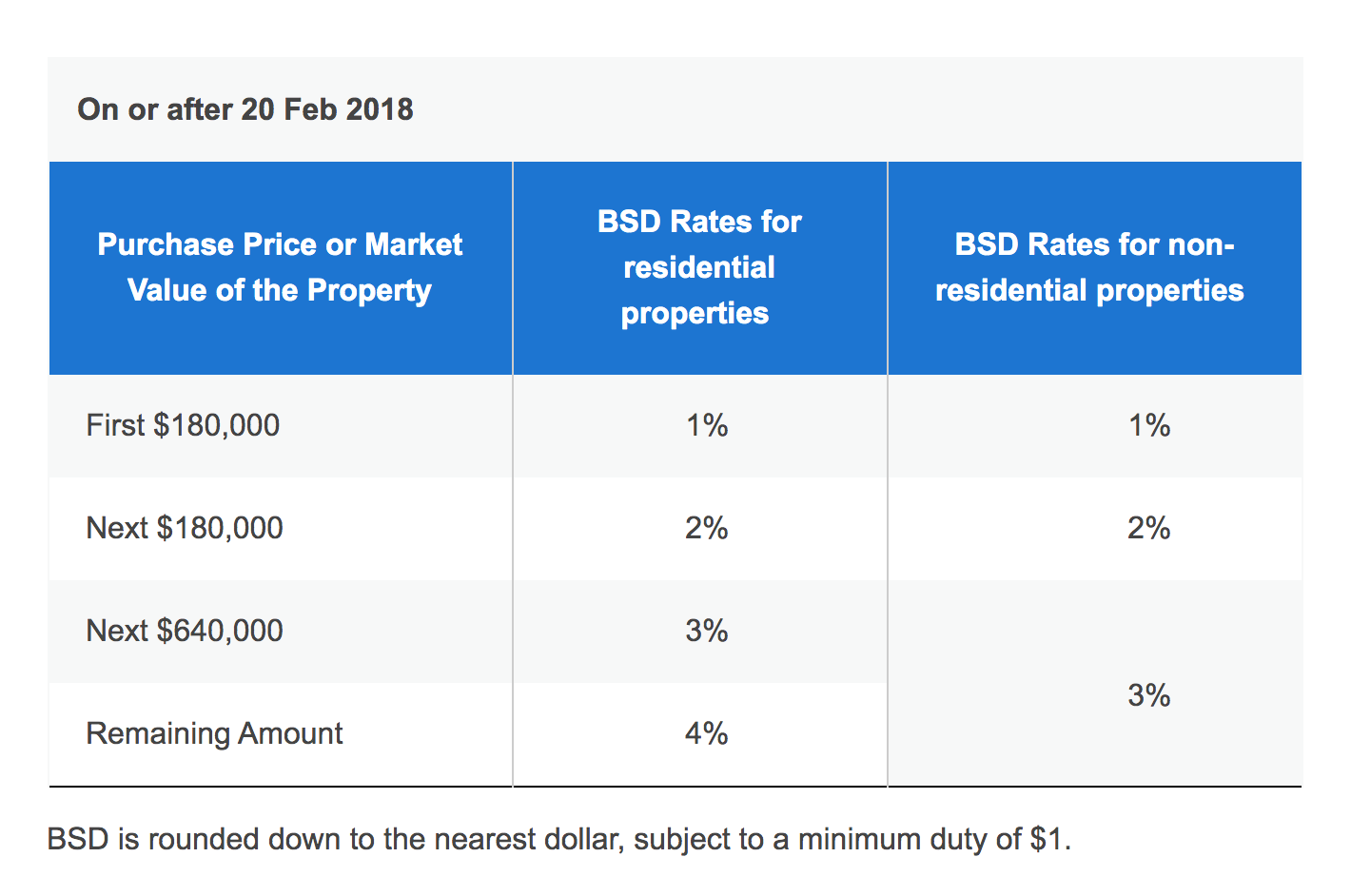

The rates as illustrated in the table from IRAS:

Refer to this table for a quick summary:

Source: Inland Revenue Authority of Singapore

Source: Inland Revenue Authority of Singapore

Example:

For a $1 million private condo, your BSD will be $24,600. Here’s the calculation:

$1,800 (for the first $180,000)

+ $3,600 (for the next $180,000)

+ $19,200 (for the next $640,000)

= $24,600

Additional Buyer's Stamp Duty (ABSD)

The Additional Buyer’s Stamp Duty (ABSD) applies to purchases of more than one residential property (i.e. 2nd property, 3rd property etc). The ABSD is payable in addition to the BSD.

Since December 2011, the ABSD was introduced as a cooling measure to moderate the demand for investment properties by both Singaporean and foreign buyers.

- Singapore Citizens are subject to an ABSD of 12% for the 2nd property purchase, and 15% for the 3rd and subsequent property purchases.

- Permanent Residents (PR) are subject to an ABSD of 5% for the 1st property purchase, 15% for the 2nd and subsequent property purchases.

- Foreigners are subject to an ABSD of 20% for all property purchases.

- Entities are subject to an ABSD of 25% for all property purchases.

Some exceptions to the rules apply:

- The first marital home between a Foreigner and Singapore Citizen is exempt from ABSD. (See ABSD Remission Below)

- Nationals and Permanent Residents of Iceland, Liechtenstein, Norway or Switzerland, and Nationals of the United States of America will be accorded the same Stamp Duty treatment as Singapore Citizens.

ABSD Remission for a married couple

A married couple may be eligible for ABSD remission on the purchase of a residential property if the remission conditions under the Stamp Duties (Spouses) (Remission of ABSD) Rules are met.

For more information, please click HERE, which will lead you to IRAS’ website.

Example:

If you are a Singapore Citizen who currently owns a HDB flat and want to purchase a private property at $1million, you will need to pay an additional 12% ($120,000) above the BSD.

Since your property count is now TWO, if you should wish to purchase yet a 3rd condo at $1 million, you will have to pay an additional 15% ($150,000) above the BSD.

If a home owner is thinking of upgrading from a HDB to a private property and subsequently purchases a second investment property, there are ways to structure such that ABSD can be minimized.

To check on your ABSD status, contact the Property Science consultants.

We’re here to help you on your real estate journey.

Contact us using the form on this page and our Consultant will be in touch with you very soon.

Or contact us by phone/email.

Call: (+65) 8363 2331 / 8778 8778

WhatsApp: Glynis Tan / Benjamin Yeo

Email: findout@property-science.com