The Loan-To-Value (LTV) is the ratio of the loan to the value of the property. The maximum LTV is 80% for bank loans. This means that if property X is valued at $1,000,000, you are allowed to loan a maximum of $800,000.

The Cash-Over-Valuation (COV) means the amount of cash you pay over the valuation of the property. If the purchase price of the property X is $1,100,000 but its valuation is $1,000,000, you will need to fork out the difference of $100,000 (COV) in cash.

Therefore, the total amount of cash you need to set aside is at least $100,000. On top of that, you will need to fork out a minimum of 5%, $50,000, as part of the down payment. The rest of the 15% down payment can be CPF or cash.

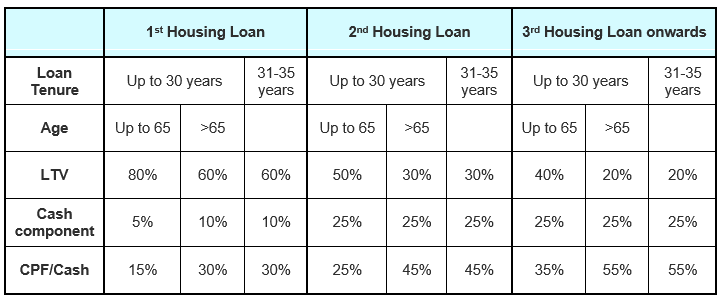

Below is a chart showing you the different LTV depending on how many mortgage loans you have.

Need help with financial calculations for your next property purchase?

Reach out to our friendly Consultants at Property Science for a no-obligation chat.

We’re here to help you on your real estate journey.

Contact us using the form on this page and our Consultant will be in touch with you very soon.

Or contact us by phone/email.

Call: (+65) 8363 2331 / 8778 8778

WhatsApp: Glynis Tan / Benjamin Yeo

Email: findout@property-science.com